Expanding from iOS to Android: A subscription app’s guide to Android

The majority of the world’s mobile users are on Android. What are the challenges and opportunities for iOS app companies?

Thomas Petit

To answer the question of whether you should launch on Android, let’s start by looking at the numbers.

RevenueCat data shows that among the 26k+ apps in 2024’s State of Subscription Apps report, 28% of apps operate on both iOS and Android, with 60% iOS only and 11% Android only.

Despite this skew towards iOS, the elephant in the room is reach.

There are over three billion Android users worldwide, accounting for 71% of all mobile users. By not having an Android app, your business is neglecting nearly three-quarters of potential users.

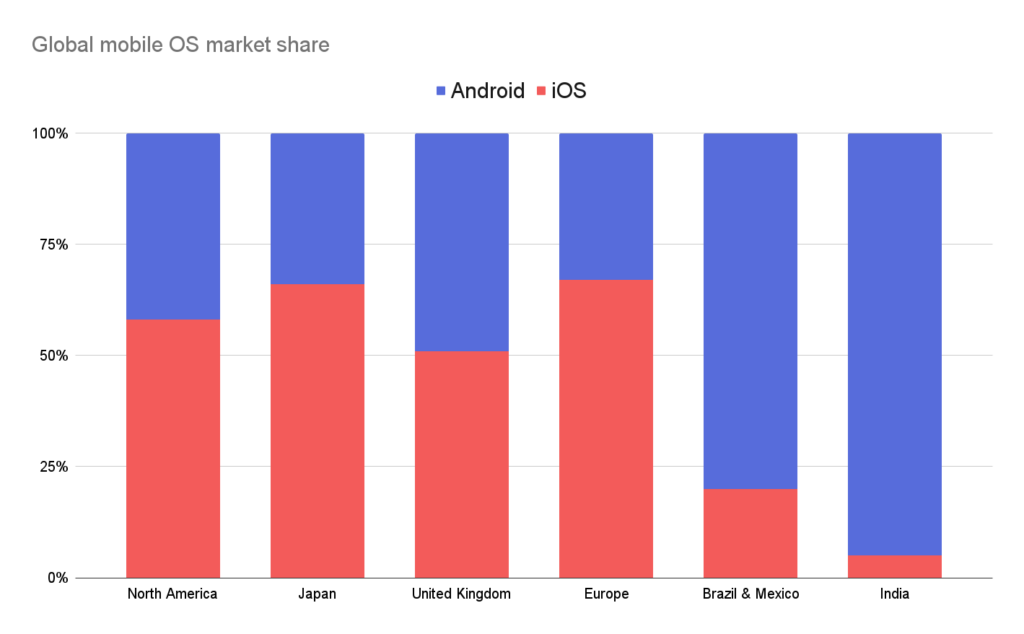

Beyond that headline stat, however, the distribution of iOS vs. Android is uneven.

A significant number of users are on Android China, which is a peculiar market that most western apps won’t be able to operate in at scale, if only because of the absence of the official Google Play Store. Instead, app distribution is fragmented between over 100 different third-party app stores.

Outside of China, the iOS/Android distribution differs highly by country:

So, the potential is in the numbers. Not being on Android would be leaving 30-95% users off the table, but what about the revenue potential?

The monetization gap — Selling subscriptions to Play Store users is hard

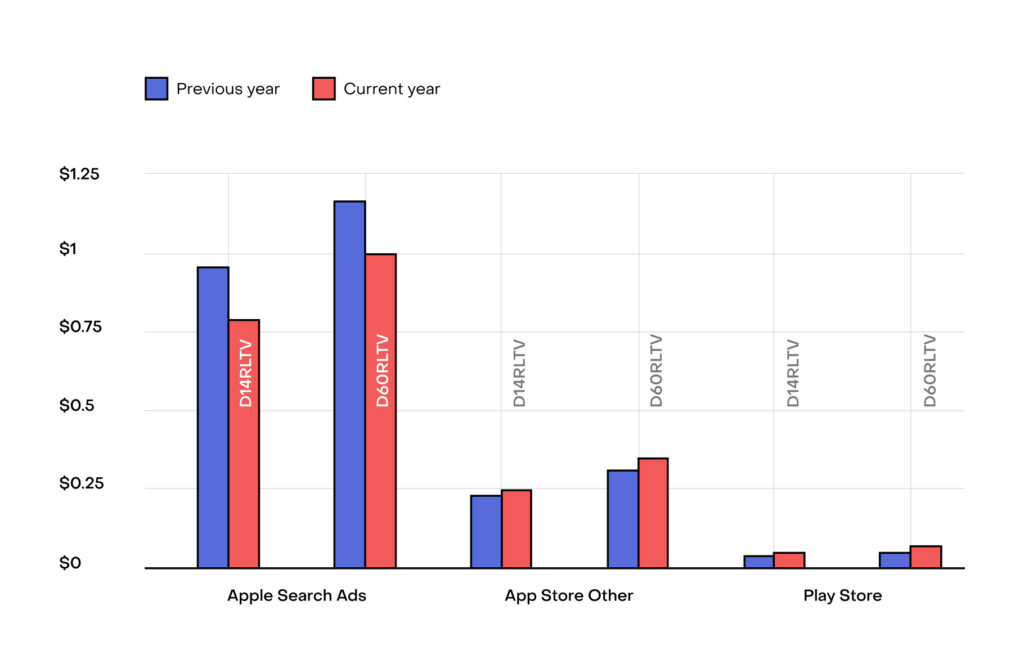

The State of Subscription Apps report shows a wide gap between the value of iOS and Android users.

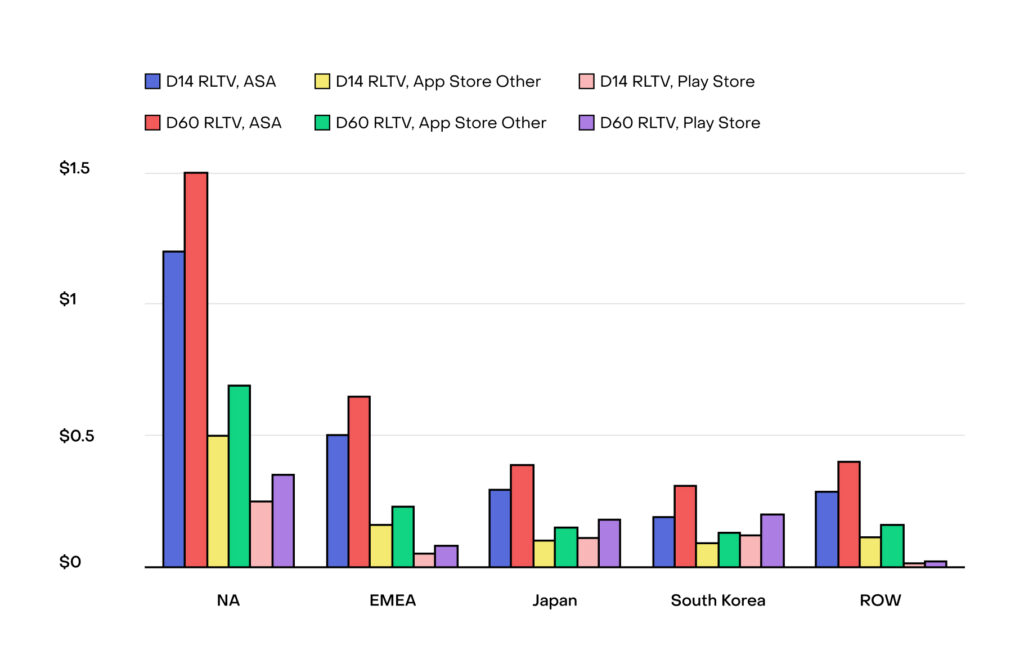

If we look at Realized Lifetime Value (RLTV) globally, there’s a 5x gap between the revenue generated by iOS and Android users (“App Store Other vs. “Play Store”). The gap is significantly wider when we compare iOS users sourced from Apple Search Ads and Android — 15.8x for RLTV after 14 days!

It is difficult to sell subscriptions to Android users, particularly due to their regional distribution (large user base in lower purchase power countries). Funnel metrics definitely surface this, with significantly lower install to trial, lower trial to paying subscriptions, and lower renewal rates, in the vast majority of cases.

It is, however, worth noting regional differences in the monetization gap. In North America, even though iOS users generate 5x the revenue as Android users, Android users still generate more revenue than users in the rest of the world.

Another interesting point is that the difference in monetization can grow over time for apps that have good retention.

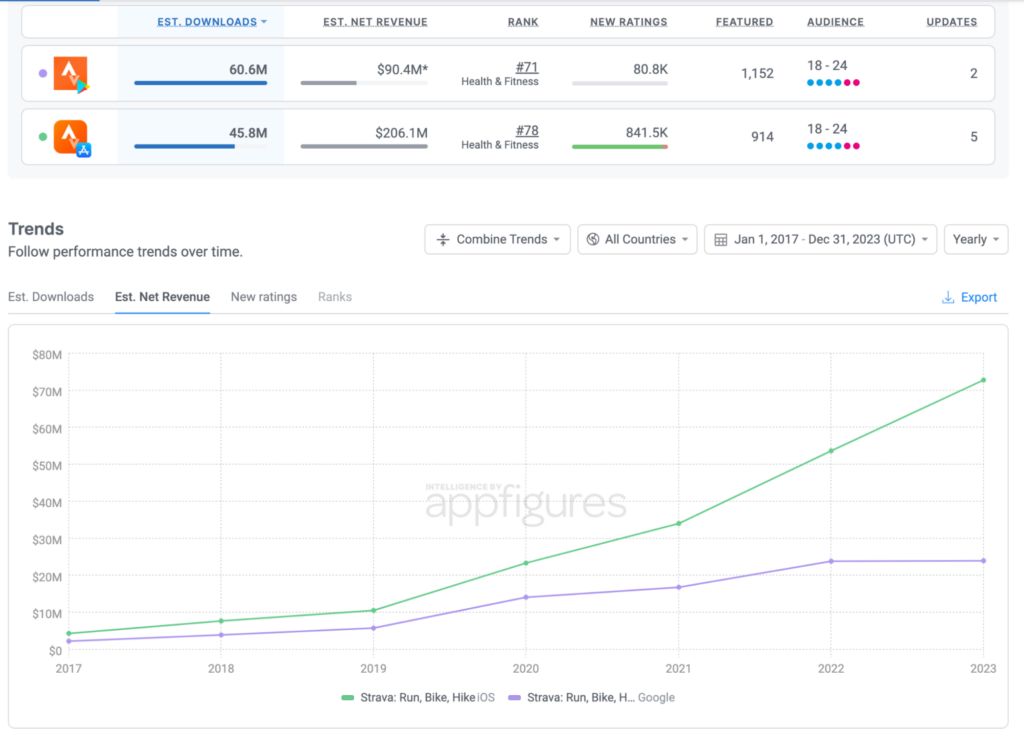

Strava is an example of an app that’s huge outside of iOS dominant markets, so early on Android revenue tracked closer to iOS revenue, but as those retentive cohorts built, iOS being monetized better causes the lines to diverge.

This is partly our own fault…

To be fully honest, it’s not only because of the users (and the platform…), but also partly due to developers themselves, who don’t keep platform parity in quality. This is illustrated with even the bigger, better apps suffering from a less updated and optimized Android app (e.g. duolingo here, here and here). Android user experience and expectation can differ — for instance what the back button should do! — as well as in general design, and without the resources to have dedicated teams, the app just isn’t as good. This can become a chicken and egg problem: if the Android app isn’t bringing enough revenue, it’s not prioritized as much, but then it’s not as good, hence it doesn’t monetize as much.

Just like with localization, where it’s not just translation, to tackle Android properly you can’t port everything. You want to hire people on Android to create , design, and QA your app, but there is also a gap in talent — it’s not so common that designers would use an Android phone in their personal life.

It’s worth noting the popularity of cross-platform frameworks like Flutter and React Native (RevenueCat’s IAP YouTube tutorial is the most popular video on the channel). These platforms make cross-platform development easier, but come with their own potential trade-offs in areas such as user experience).

The pros and cons of having an Android app

The pros

Apps can operate only on iOS and many successful ones actually do. But beyond a certain scale, this may be at an opportunity cost. Having an Android app can either yield positive impact, or be a must, in particular if:

- The app has a strong virality component. If users are willing to share the app, but their friends and family can’t install it, that can be frustrating and a loss of free traffic.

- The app is present internationally. As seen before in some countries, 80+% of the population uses Android devices.

- The plan is to establish a brand and create recognition.

- Acquisition channels are not OS specific. Meta Ads, Apple Ads, Google Ads, and Tiktok Ads are by default targeting the user’s platform. But if influencer marketing or TV are part of the channel mix, a lot of the impact is lost if users can not even install the app. On the web too, for instance, Google Search Ads do not provide a platform setting.

- If your app relies on a powerful network effect, Android becomes almost essential. The rationale is simple: more data and more users contribute to creating a better application. While “single player apps” might find this expansion less critical, “multiplayer apps” inherently gain from being universally accessible.

- Beyond a certain scale, expanding to Android is needed to eliminate reach limitations and grow the total addressable market.

The cons

For most, it’s a struggle to scale subscription revenue profitably on Android for a number of reasons:

- Less focus: Juggling both platforms may dilute the strategic focus.

- Increased bandwidth requirements: Developing for both iOS and Android necessitates dedicated resources, potentially stretching teams thin.

- Product complexity increases: User behavior and metrics on Android can vary significantly from iOS, adding layers of complexity.

- Technical challenges: Device fragmentation on Android complicates design, quality assurance, and performance optimization. Developers face tough choices between ensuring maximum compatibility and offering a superior experience to a smaller user base.

- Marketing complexity: Marketing strategies and measurement tools differ across platforms, complicating campaign execution and analysis.

- Lack of “exclusivity featuring”: Android apps miss out on potential App Store featuring opportunities that come with iOS exclusivity — but, of course, these opportunities are far form guaranteed.

Monetization and pricing on Android

How to approach iOS and Android pricing models

Most subscription apps have parity in their pricing structures between Android and iOS, but not all. Apps optimizing a lot around paywalls and subscription products often benefit from testing different price points by platform, especially in countries with significant disparities in purchasing power.

Gaming apps have navigated this by using a combination of monetization strategies. They offer non-renewal IAPs targeting users with a high propensity to pay, while monetizing the rest of the user base through advertising. This approach caters to the vast majority who may not pay but will continue to engage with the app under a free plan. Spotify or the Motivation app present a similar hybrid model, though they stand out as exceptions rather than the rule.

Take Spotify as an example:

- In Q3 2022, Spotify reported having 195 million premium subscribers out of 456 million MAUs (Monthly Active Users).

- In 2021, the platform generated $8.45 billion from subscriptions compared to $1.2 billion from advertising.

This equates to 58% of users contributing to merely 12% of revenue. This isn’t even the most extreme case, especially when considering the high percentage of paying users compared to most gaming or subscription apps. For Candy Crush, rough estimates mention that only 2% of users paid anything, and of those, 2% bring more than 50% of revenue.

In sectors like eCommerce, delivery, and mobility — who are not forced to use in-app billing — the monetization gap between Android and iOS isn’t as big. One theory is that Android users are less inclined towards signing up for subscriptions or using external payment providers compared to making one-off purchases.

Should you price Android differently than iOS?

Big apps like Netflix typically offer similar pricing across platforms, but apps with less brand recognition have more freedom to find the optimal pricing strategy through price testing.

Localization is more important on Android than iOS because of significant disparities among countries. Generally, the iOS user base in any given country has a higher net worth and income, with this gap more pronounced in countries where purchasing power is lower (where an iPhone could cost months of salary, while cheaper Android devices are readily available). Interestingly, in wealthier but smaller countries, Android users may exhibit behaviors similar to those of iOS users.

However, don’t treat all Android users the same! Zooming into the highly fragmented distribution of Android devices reveals that users of high-end Android phones, such as the latest Samsung Galaxy and the recent Google Pixel, display behaviors more akin to the iPhone population. In contrast, the purchasing behavior of less premium phone users is entirely different. The price of the device heavily influences conversion rates. There’s a correlation between reluctance or inability to spend much on a phone and a similar hesitancy towards paying for apps.

Could differing prices between Android and iOS lead to negative feedback?

For most apps the concern is often overestimated. Most users don’t compare prices across their devices and varied pricing strategies rarely elicit significant user backlash. Just as passengers rarely inquire about the price others paid for their plane tickets, app users generally don’t compare notes on pricing.

However, exceptions exist for big brands, where price differences are more likely to be scrutinized and could potentially lead to blowback. Having said this, apps like Tinder and Calm extensively test varied pricing without facing public criticism, although apps with a highly engaged community may want to be more careful. Ultimately, the impact of different pricing strategies depends on the brand’s profile.

Why are there more billing issues on Android?

A key factor contributing to the challenge of selling subscriptions on Android is Google’s payment policy. Unlike Apple, which requires an iOS user to link a credit card to their account, the Play Store makes adding a payment method optional. As a result, many Android users don’t have any payment method set up at all.

Additionally, the wider availability of freemium apps on Android allows users to bypass the need for payment by opting for versions supported by ads instead. Although Google’s official policy once mandated that subscriptions go through in-app purchases, this rule was not strictly enforced. This lax approach historically contributed to the higher incidence of billing problems on the platform.

Acquisition on Android

The simplified takeaway is that Meta Ads reigns supreme on iOS, whereas Google Ads holds the reins over Android.

On Android, Google Ads captures the majority of ad spend, contrasting with its minority share on iOS.

Despite lacking current public data, insights indicate Google commands over 70% of ad spend on Android, significantly surpassing its less than 20% stake on iOS.

Google App Ads (aka UAC), benefit from exclusive placements on Android, such as Play Store search and display, leveraging comprehensive data as both platform and ad network, and often serving as the analytics provider with Firebase. This integration enhances optimization capabilities far beyond competitors’ reach.

📖 Further reading: Read our ultimate guide to Google App Campaigns.

Android also introduces unique acquisition channels. Services like Ironsource’s Aura or Digital Turbine offer pre-loaded installs, negotiated with OEMs to have apps pre-installed on devices, allowing user activation without the need for app store downloads.

Tracking and measurement

Android’s current tracking environment mirrors where Apple stood before implementing App Tracking Transparency (ATT), with significantly lower Limit Ad Tracking (LAT) rates. Android does not require user consent to access the Google Advertising ID (GAID), enabling ad networks, MMPs, and advertisers to attribute installs at the user level without consent. This facilitates creative testing by providing deterministic data at the creative level, a stark contrast to Apple’s campaign-level data provided by SKADNetwork.

However, this is set to change as Google plans to introduce the Privacy Sandbox, phasing out GAID. The Privacy Sandbox for Android will significantly differ from Apple’s ATT & SKAdNetwork, promising a shift in tracking and measurement practices on Android (stay tuned for 2025).

App store optimization (ASO) differences

ASO on Android diverges significantly from iOS, requiring a unique set of strategies for success:

- Google’s algorithm factors in the app description for ranking purposes but doesn’t have a hidden keyword field.

- Google values comparison with peers. High churn or crash rates can lead to organic visibility penalties.

- Their algorithm tends to be more sophisticated — and harder to trick! It’s very good at interpreting typos, synonyms, and keyword stuffing, for example.

- Changes typically take much longer to show up in the Play Store.

There are also a number of differences between each store’s developer console/dashboard:

- The Play Console presents distinct advantages over App Store Connect, offering features like local icon adjustments and insights into top search terms.

- Testing options like Play Store Experiments offer more flexibility than Apple’s Product Page Experiment, although neither provides traffic source breakdowns.

- Certain metrics, such as impressions and specific app referrer metrics, however, remain inaccessible on Google’s platform.

📖 Recommended reading:

- A practical guide to app store optimization

- Black hat ASO: Are your competitors using these tactics?

Key takeaways

What have we learned about launching your app on Android?

- Global reach vs. revenue potential: Despite Android’s vast global user base, iOS users typically generate more revenue per user.

- Market and monetization gap: The gap in monetization between iOS and Android users is significant, influenced by geographic and demographic factors. However, Android users in North America still represent substantial revenue potential.

- Platform parity and quality: Often, the Android version of apps suffers due to less optimization and updates, affecting user experience and monetization. Cross-platform development tools offer solutions but with trade-offs.

- Pricing strategies: Apps with less brand recognition have more leeway to experiment with pricing on Android, considering significant country-specific disparities in purchasing power.

- User perception of price differences: Concerns about negative feedback from different pricing on Android vs. iOS are generally overestimated, except for big brands.

- Billing challenges on Android: Google’s less stringent payment method requirements contribute to more billing issues on Android compared to iOS.

- Unique acquisition opportunities on Android: Android offers distinctive channels for app acquisition, such as pre-loaded installs, that aren’t available on iOS.

- Tracking and measurement: Android currently allows more detailed user-level tracking without consent, offering advantages in user acquisition execution and creative testing.

- ASO considerations: ASO strategies must be adapted for the differences between the Google Play Store and Apple App Store, from keyword optimization to dealing with app performance metrics.

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.